BuilderTalk #1: Sei Network - We welcome all concepts of exchanges

Sei Network is a layer-1 blockchain aiming to become the foundation of the future financial system. By the end of last September, Sei had launched a $50 million package to attract DeFi projects to the blockchain.

Sei Network was founded by Jeff Feng, a former technology investment banker at Goldman Sachs. Jay Jog, its co-founder, used to work as a former software engineer at Robinhood. According to Crunchbase, Sei Labs completed a $5 million funding round in August 2022, led by Coinbase Ventures, Delphi Digital, and Multicoin Capital.

Let's kickstart the first event of #Coin98BuilderTalkSeries with @SeiNetwork!

— Coin98 Super App (Formerly Coin98 Wallet) (@coin98_wallet) February 7, 2023

✨ Topic: Sei Network: The #DeFi - Optimized Cosmos Chain Unpacked

⚡️ Speaker: @jayendra_jog, co-founder of Sei Network

Set a reminder for Feb 9th at 0:00 UTC now 👇https://t.co/8s4xcQclTl pic.twitter.com/3ROTPOF3th

“Things get messy when too centralized”

When working at Robinhood, Jog realized the biggest problem was that the company did not communicate well about internal issues. After the GameStop stock incident, Jog believes decentralization and transparency play a vital role in crypto. He also mentioned the collapse of Three Arrows Capital and FTX in 2022.

“One thing that people don’t realize at all is how powerless you feel when you work inside these places. [...] And mismanagement just keeps you in the dark about what’s happening internally”, said Jog.

From his viewpoint, anything on-chain should be trustless and transparent. Therefore, Jog and Jeff Feng started building a decentralized version of Robinhood two years ago. This led them to look down every layer 1, layer 2 and important infrastructure to develop an exchange.

Jog dug into the exchange trilemma: decentralization, capital efficiency and scalability. According to Jog, exchanges tend to attain only two of those three criteria. For example, Uniswap V2 gets decentralization and scalability but capital efficiency. Meanwhile, Binance only gets capital efficiency and scalability but decentralization.

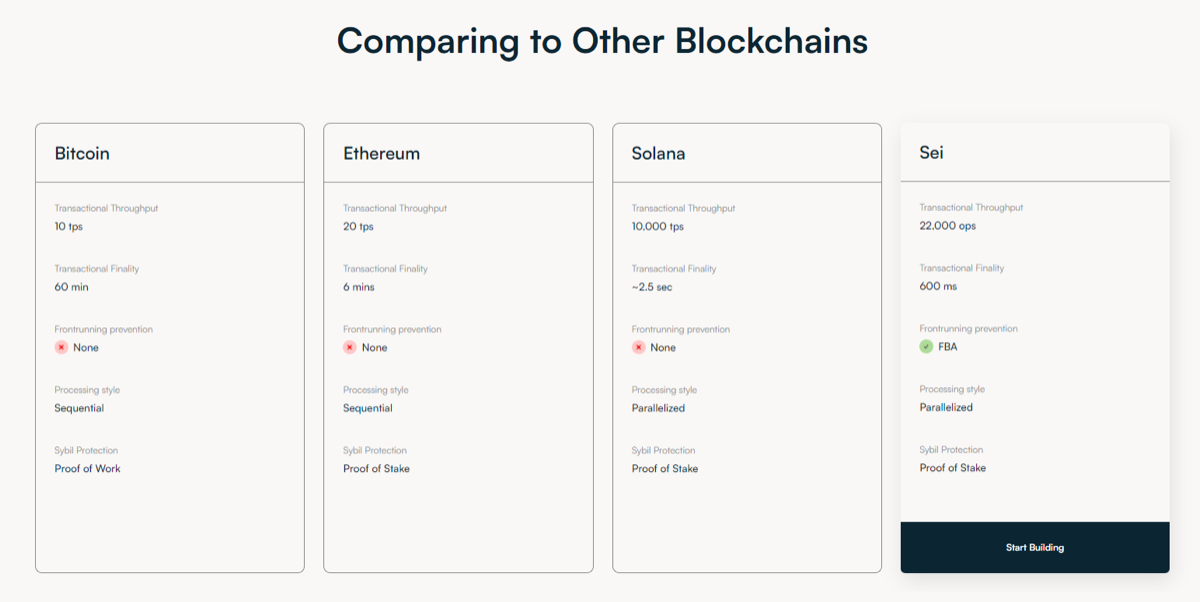

Sei team thought the best solution was to do a complete rewrite of the underlying infrastructure rather than the exchange itself. Given Ethereum, there are many projects including decentralized applications, stablecoin, etc. While Ethereum serves the general purpose, Sei’s mission is to build a specialized infrastructure for DEX to better user experience. The main benefit is customizability. Developers can build the specialized type of infrastructure for the exact type of application and use case.

“Building rollup on Ethereum is not the best solution”

Considering rollup, Jog supposed the fundamental problem was rollup technology had not given the optimal scalability yet. Although little computation happens on the core layer (Ethereum), there is still a bunch of data on it. Ethereum has a target block size of 15 billion gas and each byte written costs 16 gas. However, Jog believed the limit in scalability would be mitigated once rollup reached the proto-dank sharding stage.

For Sei, building their own blockchain also helps eliminate shared security and congestion issues. The project can customize anything from scratch and change every part afterwards to optimize diverse use cases.

“Operating on a sovereign blockchain, DeFi applications on Sei receive the security and resiliency of the Cosmos infrastructure,” stated Jog.

Sei Network was able to gain more transactions through intelligent block propagations. To illustrate, Jog compared the intelligence system as a home library. Bob is reading his favourite book but he wants to share with Alice. There are two ways he can communicate with Alice.

The first is to tell her: “This is the book that I like. You can check the library to have it”. Afterwards, Alice may go to the library and read the book immediately if she finds it. If she could not find it, she had to wait and receive the book from Bob. In the other situation, Bob may promise to give Alice the book next week. She still gets the book from Bob and reads it later.

The second approach is how Tendermint currently works and the first approach is intelligence block propagation. Jog insisted approach A was much faster and more efficient. Block producers send a message. If a validator has the block contents in their mempool (Alice has the book in her library), they can start processing the block immediately.

Besides, Sei aims to optimize block processing. When the validators see the block, they can start processing that block and update the content. If the block gets approved, validators could commit it. If the network disapproves of the block, they just need to discard previous steps. No waiting time remains.

Sei and future airdrop

From Sei’s view, exchanges are the central point of any DeFi ecosystem. Sei wants to achieve lightning-fast transaction finality of 600ms and 22,000 orders per second. “Last year we had a few exchanges to build on the chain. They were extremely enthusiastic about the underlying infrastructure”, said Jog.

Exchanges are integral in any application. For example, if you build an NFT collection, the primary use case for NFT right now is speculation. So every NFT has to entice to NFT marketplaces. That is why ecosystems like Solana have been able to do very well because they have marketplaces like Magic Eden to get a lot of fractions.

The core of sovereign blockchain is that it can be flexible for various purposes. Sei does not want to be limited by a particular concept of exchanges. There will be not only DeFi exchanges but also applications for gaming, metaverse, or NFT.

Mainnet launch

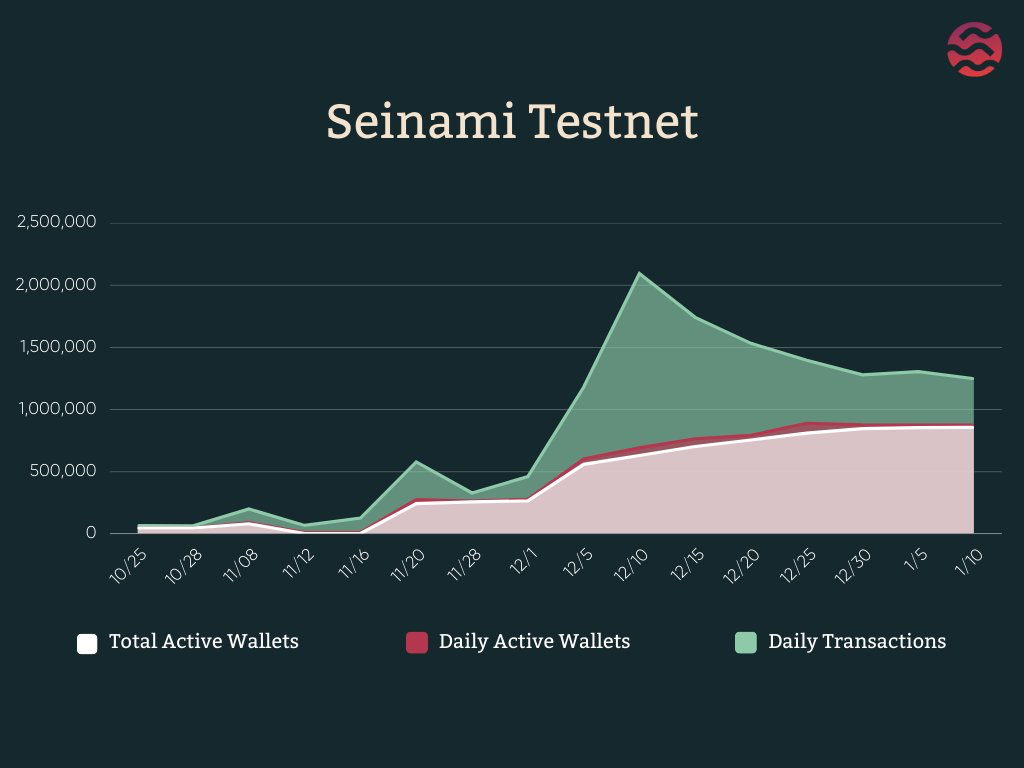

Sei is still in the testnet phase. As a result, incentives for the projects building on Sei Network are among the community's concerns.

"Now we have over 100 teams onboarding Sei. We have a lot of ways to provide incentives. Sei has an Incentivized Testnet Program. This program will reward anyone, not just validators, who interact with the blockchain and the applications", Jog clarified.

Users can create a wallet, which anyone can do. Afterward, they can perform some submissions and earn bonus points. Once the mainnet launches, there will be benefits for people who have joined the incentivized testnet.

Jog expected the mainnet launch would be in Q2 this year. The testnet is scheduled to come later this month. If the testnet goes smoothly, the mainnet will be launched as expected. Jog repeated there would be an airdrop around this time. There will be a lot of ways for people participating in the network to get rewards.

Q&A Section

Builder of Sei Network

What kind of image, character, or object comes to mind when you hear the word Build or BuilderDo you have similarities between you and Builder simply since you are building a Sei Network?

That's an interesting question. So I grew up in Bangalore Silicon Valley, when I hear the word Build, a laptop comes to my mind. And like on the hackathon, at 2 am, everyone has a laptop in their hand. Happy on whatever project, they want to give presents. The initial 414 writing the code gets the product to make everything work and infrastructure for the exchange.

Do you and your team struggle to build Sei Network?

I think the team's background is from Robinhood. So we have a lot of very exceptional Web3 engineers. It's strange to work building with Cosmos SDK and terminal core. Thankfully the Cosmos ecosystem for getting technology credited to easy to use.

The biggest thing we are focusing on right now is getting good developers to learn about Sei, start building on Sei, and make the process easy. If anyone is interested in learning more about Sei, we have a program to get on, Set Network, and 75,000 ecosystem funds to get on the ecosystem as well.

What’s up for Sei Network?

Do you have any target demographic and geographic focus on using a network?

The type of folk we want using Sei are ordinary people, and people in Robinhood hope to get into trading. So first, Sei will launch, and then many crypto natives will come initially.

Afterward, there will be some apps, extremely popular in the future. More normal users like my friends start using Sei. Now is the right time to come in, and the institution to come feeling it is the right time to come in, many things are derisked for us. So we are going to make a transition to using Sei.

When Sei gets to the mainnet, will the bridge be officially built by the team or the side team?

The bridge between ecosystems is vital for us. Because as a trading focus ecosystem, we want an attitude responsible for everyone bringing liquidity to Sei. We don't want to maintain that structure ourselves. A bridge is the most difficult to build correctly in crypto. And if you make it incorrectly, it is extremely easy to lose a lot of money in crypto. So we don't take care of ourselves. Primarily, many exceptional teams already building bridges are interested in working with us.