BuilderTalk #2: Explore Liquid Staking On Cosmos

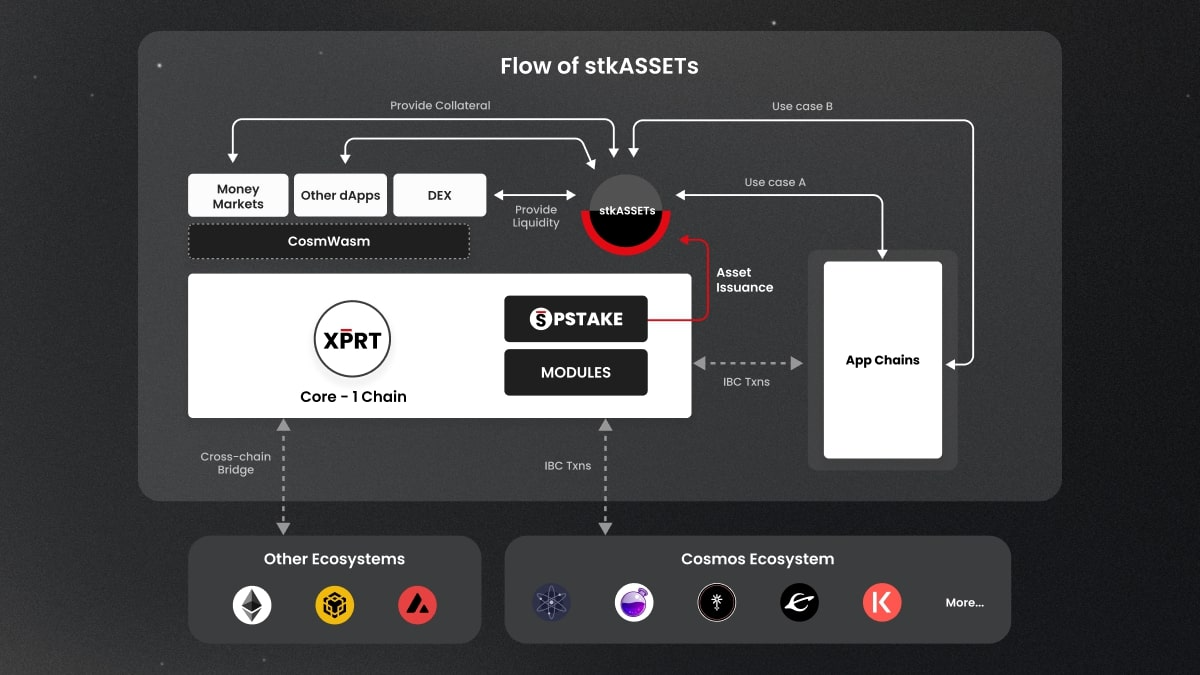

Persistence is a Tendermint-based, specialized Layer-1 network powering an ecosystem of DeFi applications focused on liquid staking–issuance, deployment, & DeFi primitives such as lending/borrowing and liquidity provisioning on DEXs for liquid staked assets.

Interested in liquid staking?

— Coin98 Super App (Formerly Coin98 Wallet) (@coin98_wallet) February 14, 2023

Join us on Feb 16th at 8:00 PM (SGT) to explore this topic on #Cosmos with @PersistenceOne's founder @Tushar307 and @pStakeFinance's lead @PandeyMikhil.

Set reminder & see you there👇https://t.co/gr8IOSqMjX pic.twitter.com/jzNhtGEUXa

Tushar Aggarwal is the Founder and CEO of Persistence. He started his career in the blockchain/crypto industry when hosting the Decrypt Asia podcast and writing extensively about this area of Tech in Asia. Then Tushar joined as the first employee at Singapore-based LuneX Ventures. Seeing an opportunity to contribute more to the ecosystem by being a founder versus an investor and bringing institutional capital into the industry, he started Persistence in Q2 of 2019.

Builder of Persistence and pSTAKE Finance

For Tushar, one of the important things is that builders have to be persistent for a very long time. Especially, in crypto, it's not always a good time. One of the great things about crypto is hard work for the long haul. That's how he started with Persistence. Persistence is the criteria we choose from the very beginning.

Moreover, Tushar said that he has been in the industry for about 6 years and has seen different cycles. Many projects come and go. There are lots of challenges and failures in this area. It's important to go in the right direction, so builders really need persistence. It makes him think of someone who overcomes every challenge in certain moments. That's also what he can do with DeFi products.

Besides Tushar Aggarwal, Mikhil Pandey - Lead at pSTAKE Finance also participated in the second episode of Builder Talks and shared many perspectives on crypto and liquid staking.

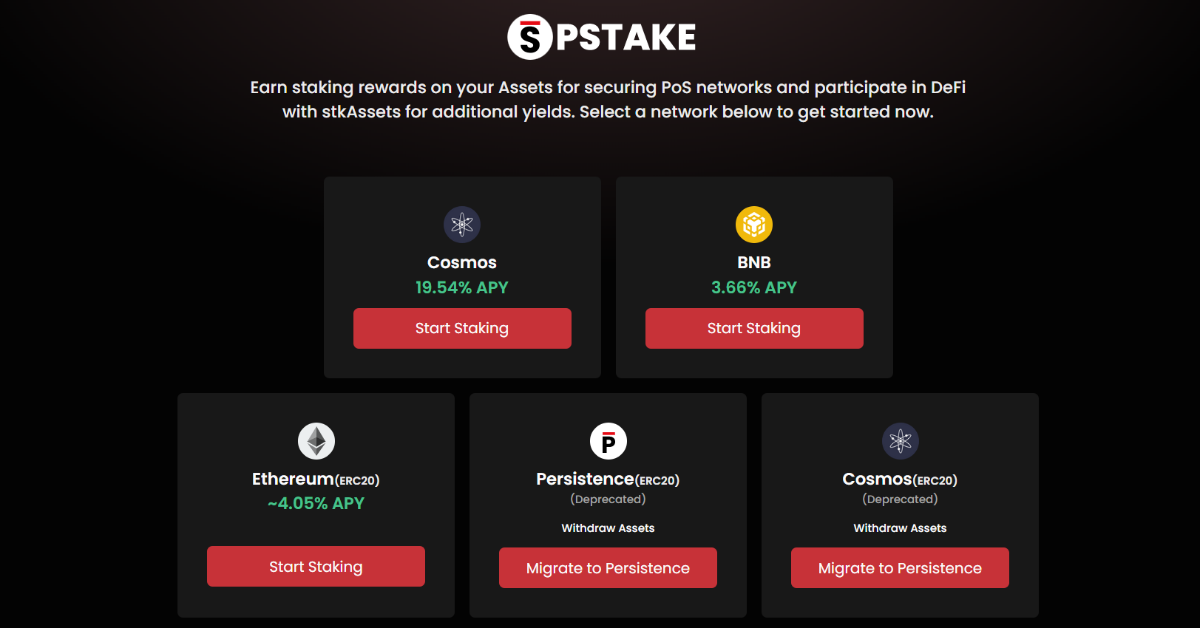

Developed by Persistence, pSTAKE is solely focused on the issuance of those liquid-staked assets and getting users to use those liquid-staked assets for multiple use cases. pSTAKE’s liquid staking solution is live on four chains: Cosmos, Ethereum, Persistence, and of course BNB. Additionally, pSTAKE is developing liquid staking solutions for other leading assets in the industry.

For Mikhil, it all starts with humility and integrity. Especially in the cryptocurrency industry, these factors are even more essential. Those values will help him to be much more patient because not everything will always work out. Then Mikhil and his team focus on liquid staking and spend more time on this area.

“Creating a product is not a simple journey”

Tushar Aggarwal believes that the journey to creating a product is not a simple one. Persistence is the early Cosmos community and they are early believers. In his opinion, each big application chain can have its own chain. For example, dYdX has switched to Cosmos and operates its decentralized exchange on this blockchain.

“If we look at the models on the Ethereum blockchain, they are very general-purpose blockchains and want to appeal to all kinds of different use cases. Those are some game apps, DeFi apps, and NFT apps”, said Tushar.

For Persistence, what he wants to do is create a specific usecase for investors and it may not work on other use cases or not on other projects. That allows his team to tune the parameters for finality.

Persistence started at the end of 2019 when the bear market took place. It was a very difficult time to raise funds, so Tushar and his team decided to run validators and nodes to generate revenue. That money is used to pay the group's salary. It helped Persistence exiting during the tough times.

The co-Founder of Persistence said that he had to deal with revolved around financial aid. There are a lot of issues when it comes to getting real-world assets on-chain while his team is working on our cost-cutting plan for 2020.

During Persistence’s StakeDrop campaign, a token distribution mechanism that allowed token holders of some of the most prominent Proof-of-Stake (PoS) networks to get exposure to XPRT tokens, there was participation from a total of ~$1 billion (at 2020 prices) worth of assets. . That helped him realize that a large amount of end-user demand is the driving force to make better versions.

Liquid staking on Cosmos

From Tushar’s point of view, staking at a high level is a rewarding journey. Now, Persistence is continuing to build the base ecosystem. This is where it will create liquidity for assets in the liquid state.

In the future, Persistence will try to bring native Dex into the system and create other use cases for liquid staking tax. All of these products should be built around liquid staking assets. That will make the Cosmos ecosystem more dynamic.

Besides, Mikhil from pSTAKE Finance thinks that staking is the most important part of the Cosmos chain. Accordingly, users do not need to run an authenticator or authorize to use this feature.

With pSTAKE and Persistence, the team is creating an ecosystem around liquid-staked assets. These projects aim to become a one-stop solution for liquid staking, from asset issuance to DeFi-based use cases with yield-bearing assets.

The pSTAKE team is entirely focused on building the best liquid staking solutions across different PoS chains. The broader Persistence ecosystem teams and contributors are working on use cases for yield-bearing assets like cross-chain asset exchange and borrowing/lending of staked assets. This project will branch out into other use cases like options, derivatives, creating an index for PoS tokens, and many more.

Moreover, his team realizes that the borrowing and lending feature will bring many opportunities to users. It is also an investment opportunity in the DeFi world. For Cosmos and pSTAKE, users can deposit assets and can bet. Liquid staking is one of those simple features that users can use on many different platforms.

"We want to make pSTAKE as secure as possible."

Mikhil mentioned their three principles for a staking protocol: security, user experience, and utility. So in that particular order, they want to make our building as secure as possible. Having a monitor in place ensures everything goes sound and notify immediately if something goes wrong but try to ensure it never comes to that.

Number 2 is user experience. It is different from what most people look at, the liquid staking protocol, as users look at it when they deposit an asset, receive an NFT delegate, and use that NFT in whatever they want.

From their perspective, user experience comes from how the protocol works, ensuring the user's staking asset is kept from getting slashed or not affected significantly.

When users stake in a validator because it is proof of stake, they will get slashed if the validator is malicious or has downtime not producing blocks. Slashing is not very common; double signing is not typical, but downtime slashing where the validator is running can happen to anyone you might have an issue with who is off to be upgraded.

For example, a validator with 1 million in stake maliciously signs a block; they haven't doubled marking the situation. So, a portion of 1 million would get slashed and burned from the supply, and users would lose some money or assets they staked.

"Pstake wants to ensure that even if the validator gets slashed, it does not affect the user that big," Mikhil said.

Pstake does this, unlike the other liquid staking protocol, where they delegate user asset split to a few validators. Instead, the protocol ensures that the delegation is divided across multiple validators. So even when a validator gets to slash, the risk to other users gets significantly lower than what it would look like in other protocols.

Finally, the protocol wants to improve the liquidity of the liquid staking asset. Therefore, Mikhil supposed liquidity is the primary concern for the user when using a liquid staking protocol.

For example, a user wants to hold stkATOM, but the liquidity in Osmos is about 2 million USD, which is a decent amount. But if he wants to stake a large amount of ATOM on Pstake, the first concern is how he could get out of stkATOM to ATOM when he needs to.

To tackle that problem, pSTAKE started with the redemption model. The user deposits an asset against the user withdrawing that asset.

"For example, Tushar wants to delegate some assets, and I wish to unbond my assets. I get atoms back from stkATOM. The risk is when unbond on the protocol; you have to wait for the unbonding period, or they swap it out stkATOM for ATOM on a DEX. But we provide users with other options. When Tushar deposits some assets, Tushar's assets turn into mine, and my stake comes to Tushar's address", Mikhil explained.

Instead of using a dex with a higher slippage, Pstake solves that problem, which is one major problem with most liquid staking platforms.

"Cosmos and app chain philosophy is a belief to us"

Let's move to the reason why Persistence is building on Cosmos.

Tushar, the founder of Persistence, said they believe in the application scheme philosophy to have their blockchain and control chain-level parameters.

"In Defi, it becomes super important. For example, you have a borrowing lending application on a chain, and the price is falling, and liquidation is happening. So you want a chain to have copper as well as finality. So application philosophy, along with interoperability with other blockchains, is a belief to us. As already highlighted, we are early believers and builders in Cosmos", said Tushar

On the other hand, the proof of stake itself was not that popular then. At that time, there were only two proof-of-stake chains: Tezos and Cosmos. And after having technical intelligence, Persistence team found that Cosmos has much better tech and a larger developer community.

Although, from a high-level perspective, Cosmos doesn't have the best BD team. This is a long-term bet. And their belief has enough time horizon for Cosmos to attract enough builders. As opposed to other chains that have a good BD afford but are still unable to bootstrap that developer community.

Tushar insisted that there will be a strong narrative and greater awareness around Layer 2 and the app chain in the coming month and year.

"It has already been three years for us, but we bet on this and see it becoming more authentic. I've been an investor. The good thing about investing is that you could change your mind and keep buying and selling coins. But as a builder, you must have a more comprehensive vision, and you can change your mind daily because you rely on the team and the project's direction," Tushar continued.

"XPRT is the center of the entire ecosystem."

For Persistence, XPRT is the center of the entire ecosystem. Tushar said they would launch liquid staking XPRT. What that will do is, again, more bootstrap liquidity for stkXPRT.

Answering why to keep the staking rate on the chain very high, Persistence team does not give up the liquidity and volume for XPRT and creates other exciting use cases for borrowing XPRT while staking on the wallet.

We want to make value accrue to the XPRT; ultimately, many use cases around XPRT and stkXPRT.

Alpha leaks

For high-level alpha, Tushar shared that they will ensure liquidity on the dex for liquidity stake assets like stkATOM by launching new products.

pSTAKE is the first application that focuses on the asset issuance of stkATOM or stkXPRT. Users can find liquidity of staking assets on various dexes like Osmosis or Crescent. That will happen through another application launched on top of the Persistence chain. Dexter zone is the name of an application where liquidity will be bootstrapped.

Dexter has traveled far and wide and knows a lot about AMMs, and now brings all the wisdom into building its AMM base on Persistence Core. Let's take a look at its plan for the base 🧵

— Dexter Zone (@dexter_zone) January 26, 2023

Read More 👇 https://t.co/9ZLt5tMLCu

Persistence team also cares about the token. Creating liquidity for the chain and gaining greater traction regarding the number of wallets and transactions is more significant for XPRT to move up in the ranking on the market cap.

"We make sure to build a solid product and good traction. We do right by token holders, different community members, including validation, team members, and who bought the token in the market. We appreciate the help of the community. It's stuff to be a builder. It takes time, effort, and persistence," Tushar illustrated.

Q&A Section

The origin of Persistence

When building pSTAKE or Persistence, do you have difficulty?

The most serious difficulty was working under the technical limitation of the relyed chain. In 2020, Cosmos did not have IBC, Osmosis, dex, or DeFi in the Cosmos ecosystem.

But we did a lightly unconventional issue stkATOM on the Ethereum network by building our bridge, issuing assets directly on the Ethereum side by issuing on cosmos, and then taking it into Ethereum.

Why did you build a liquid stacking protocol in the first place? What motivated you to think liquid staking was successful at first?

The primary reason was that we took a stake drop campaign when staker absorbed assets like ATOM and KAVA. As a result, we earned more than 1 Mil USD in the stake campaign for three months.

That gives us insight into how much market-driven and user-driven demand liquid-staking we still think it is.

We are not finding a way to solve the problem. But we saw an opportunity, and we jumped on it.

Can you share any funny and exciting stories about the building process?

Late year, after things open post covid. It was the first time we met other team members. That is exciting and something we want to do again and get the whole team together. Yeah, outside, something fun and get the team closer.

Future of XPRT token

Do you guys have another use case for the XPRT token?

As already mentioned, many things we are trying to do is add a use case to the token. Now, you can stake it through your wallet. Users are also aware that when staking, they secure the chain, taking part in block production. Token holders can participate in governance. In the coming month, we will create liquid staking of XPRT and liquidity for stkXPRT in the native dex, Dexter. We will be making borrowing lending features for it and many financial uses.

Related: BuilderTalk #1: Sei Network - We welcome all concepts of exchanges.