Buildertalk #6: Inside a fast growing Layer 2 scaling solution

Arbitrum is a Layer 2 solution for the Ethereum blockchain, designed to improve the speed of transactions, increase scalability, and boost the network's privacy. It allows users to perform transactions off the leading network and has them verified and batched before being committed back to the main chain.

Arbitrum emerged as one of the best Ethereum scaling solutions last year. According to DefiLlama, Arbitrum's TVL peaked at around $2.35 billion in November 2021. On March 23, Arbitrum finally distributed its highly-anticipated ARB token, decentralizing its inventory into the hands of its early adopter.

Are you ready to take your knowledge of L2 scaling solutions to the next level?

— Coin98 Super App (Formerly Coin98 Wallet) (@coin98_wallet) May 9, 2023

Look no further than our next #BuilderTalkTheSeries featuring @arbitrum!

Join us on May 11th, 2023, at 1:00 PM (UTC) for an insightful conversation with @stonecoldpat0, Research at #Arbitrum… pic.twitter.com/vwMgfgDQyz

Pattrick got into the crypto industry back in 2013. He did Ph.D. in Bitcoin and Ethereum from 2013 to 2016. After that, he got a postdoc and professor from 2016 to 2019. So then, Patrick decided to quit university and try to do it from 2019-2020. Then he joined Arbitrum 5 weeks ago, doing a lot of research.

Regarding "build" or "builder," Patrick is immediately reminded of the final conference of Roger Needham, his academic grandfather, in 2003.

"I have the greatest respect for the people who have built the theoretical underpinnings of our computer science subject, and we wish them every success because it would enable the people who want to get on and make things, to do it better, and to do it more quickly and to do it with fewer mistakes. And all of this is good, but, at the end of the day", Patrick remembered.

"Rollup in a simple way"

Arbitrum is a blockchain scalability solution. The best thing to describe this sort of technology is its existing example, Coinbase. When someone comes to the cryptocurrency exchange, they send their crypto asset into a centralized exchange, then get locked on the bridge and appear on their website database. They trust the exchange to protect their fund. If they disappear or freeze, their fund can not be recovered. But the good things at Coinbase are the user experience, low fees, and fast.

When locking into Coinbase, users lock into the bridge. Coinbase has full authority for the bridge and responsibility to protect assets on that bridge. For Arbitrum or any rollups, they still take funds and lock them into the bridge, and they still appear on the off-chain database. The difference is that the bridge is operated by the other system responsible for protecting the fund. For example, when you use Arbitrum, users trust Ethereum to protect their funds.

Decentralized in Arbitrum is that users can afford the network. Ethereum is expensive. It costs 100 USD for each transaction, which keep the user away from using blockchain technology. Such a rollup like Arbitrum reduces the user's fee while maintaining security. Today, users can swap on Arbitrum for 80 cents, compared to 30 to 40 USD on Ethereum. The reason for that comes from the technology stack.

The Layer 1 decentralized system depends on the system's operators, like miners, validators, etc. So we need to maximize the population.

Layer 1 wants to maximize who can produce the block and verify everything is correct. Hopefully, Arbitrum assumes it already exists. In Arbitrum, multi transactions are executed off-chains elsewhere; Ethereum saves tiny proof that all this is done correctly. So the decentralization on Arbitrum assumes decentralization on Ethereum.

The significant point about decentralization is about service providers as well. Arbitrum can minimize the trust between the user and the operator. When a user deposits funds into the bridge, the user does not need to trust the operator. If the operator is offline or malicious or the entire rollup is offline, the user can eventually recover their funds. So the fund never gets trapped in the system.

"We break down the trust barrier between the user and operator. As a result, more people can offer the service on the Internet because we don't need to know who they are. Right now, we have ten rollups. Maybe in the future, there will be hundreds of thousands of rollups. That removes friction when we interact with people on the internet".

Trustless and frictionless is how Arbitrum can level up decentralization and bring DeFi to adoption.

Strong community on Arbitrum

The community is proactive. The Foundation is the responsibility of the DAO. DAO is a decentralized autonomous organization. The token holders can raise proposals and safeguard the Arbitrum Network.

The members of the DAO are very proactive. A lot of members care about the evolution of Arbitrum, like MEV. Outside of the DAO, Arbitrum has a lot of users. Arbitrum One and Arbitrum Nova recently have one million transactions on the database with a speed of 7 TPS.

The point of DAO has many responsibilities. The ultimate goal of the DAO is to protect the Arbitrum protocol. Therefore, any upgrade must get through the proposal before deployment on the network.

The second purpose is that the DAO has a treasury that distributes incentives for the public good in the ecosystem. The third is to hold the Foundation accountable.

Foundation focus on education developers

The Foundation understands how we can help developers and projects on top of Arbitrum—for example, the partnership between us and the developer. What I focus on is education. There are a lot of guys out there who want to join the cryptocurrency industry but are afraid to dip their toes into it.

The Foundation focuses on education, from blog posts to online classes. In addition, I am hosting ECC and other cryptocurrency events, where people can come to the workshop to learn about Ethereum and Arbitrum. So that more developers can join our community.

Developer experience is their ability to write smart contracts and deploy them on the network. All rollups are doing slightly different things. For example, StarkNet has a custom development environment. It doesn't look like Ethereum at all when you develop in it. Others like Arbitrum, Optimism, Polygon, and zkEVM are the base level and solvent of the EVM. You can easily create and deploy intelligent contracts as quickly as Ethereum.

However, Arbitrum wants to go further. The upgrade we want to see is stylist, also called EVM Plus. It currently works on that allow developing another language like Rust. For example, you can create a Rust contract and then deploy it on top of Arbitrum. Rust contracts still interact with most contracts on the platform as well.

Q&A Section

Beginning the Q&A section, Interlock asked McCorry about layer-3 projects built on Arbitrum. We also wanted to know whether these projects planned to launch a token or incentive program for the users. Regarding tokens and airdrops, McCorry refused to reveal further information. Instead, he thoroughly explained Arbitrum Orbit and the current state of layer 3 in a technical way

Can you share with us about the layer-3 projects building on Arbitrum?

On Arbitrum Orbit, there is a project called AltLayer, which has been going down this line of work for a while. With AltLayer, you can enhance a lot of computation in a short time, and then send the final result to the smart contract of other blockchains like Arbitrum.

They are using Orbit to work on that now. You can expect an airdrop or NFT drop once these projects are finalized. Arbitrum has a vast ecosystem with lots of different smart contracts and users, so there is a lot of motivation for people to build there.

Layer 3s are deployed on top of Arbitrum One. How do layer 3s publish their calldata on Orbit?

As these systems are databases, the importance is how we can guarantee that anyone can access this database. And with rollups, we tend to put all the databases on Ethereum. If they can access Ethereum, they can recompute the database's copies.

Nova is slightly different. These layer 3s typically rely on a so-called data availability committee that will attest to whether the data is publicly available. We have eight members who will take turns to take the data, sign it and assure the users that all the data is ready.

In Nova, you always assume that one or two parties are honest and always protect the safety of the network. The network will not post the data onto Arbitrum or Ethereum. It will be sent to the committee to be signed off to allow everyone to get a copy of the data.

Imagine someone deployed some versions of Tornado Cash on layer 3. Is there a chance for layer 3 to be censored by the Sequencer?

Regarding censorship resistance, I do not want to use Tornado Cash as it is controversial. If Arbitrum went offline, how could we guarantee that users could transact? We will use a force inclusion mechanism to post the L2 transactions directly on Ethereum. After 24 hours, they will line up in a queue to be executed.

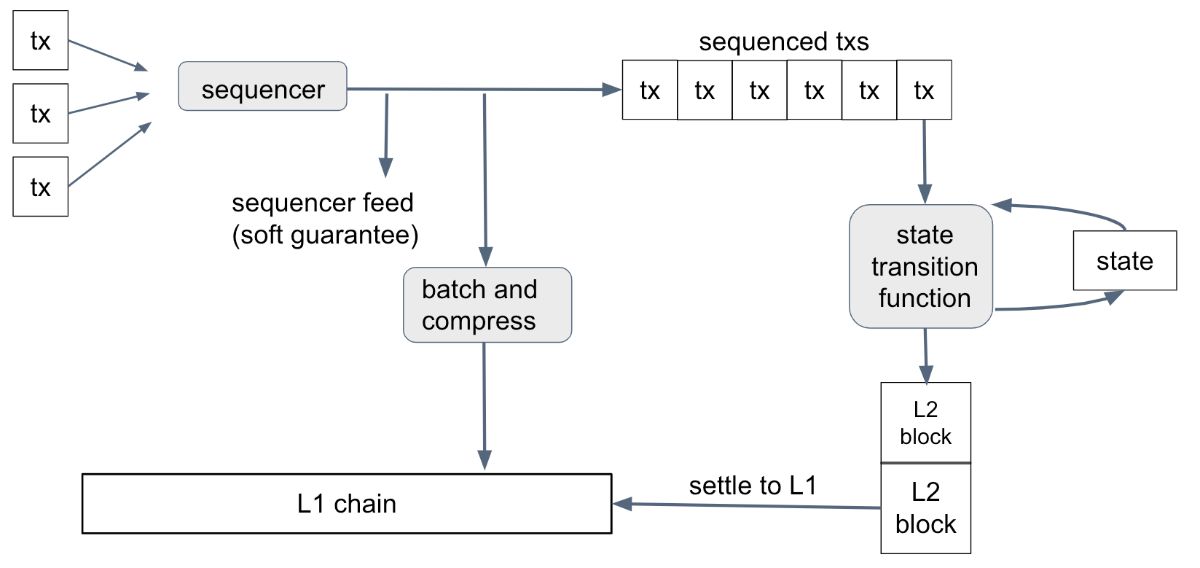

In rollups, there are two parties. First, the Sequencer takes a list of transactions, orders them, and passes them on. Once there is an ordered list of transactions, there come executors, validators, or provers to execute the transaction data and post it on Ethereum. They must execute all transactions orderly according to the bridge set on Ethereum.

Arbitrary Foundation has updated its license for Nitro to be deployed on Arbitrum One or Arbitrum Nova. Developers can fork the code of Arbitrum, customize it for specific applications, and deploy them on top of Arbitrum One and Arbitrum Nova.

Arbitrum Nova uses Antitrust technology, in which an off-chain committee will execute and attest to transactions. Nova is an instance of L2, but you can take the same software stack and redeploy it on L3 on Arbitrum One and Nova. Generally, you can take that Antitrust code to deploy on top of Arbitrum, and it just becomes an L3.

What is the future of layer 2?

When you look at Web2, the problem of Web2 is that we have to trust our funds to anyone from the project and hope they do the right things. We have to trust humans to enforce the rules. Meanwhile, humans are not very good at this. We have seen the terrible case of Partygate in the UK.

The layer-2 vision and the Web3 vision are building a new technology stack where we can deploy the software, and it will enhance the rules instead of humans. Everything is transparent, everyone can view it, write on it and see what the rules of the game are before interacting with it. And that is the future of layer 2.

We now have the technology stack that hopefully any financial service in the world can reinstate and deploy. There is a Google quote: Don't be Evil. For me, it is: "Instead of don’t be evil, they can’t be evil". The software will not allow them to be.

Layer 2 has a better technology stack where the software enforces the rules. Hopefully, we now have ten rollups and I would love to see hundreds or thousands of rollups in the future. They will help bring down the fees for users so they can afford to approach these networks as well. But it is all about trust and minimizing trust.

What is the hardest thing when building in the bear market? How can you overcome this situation?

I have been in cryptocurrency since 2013. I saw the bear market in 2015 after the collapse of Mt.Gox, and in 2018-2019 after the fall of ICOs. The bear market does not fear me at all. I get excited because we could have cool projects coming out as people are more hyper-focused and genuinely want to build cool stuff that helps people.

The ecosystems are so much bigger now than they used to be. From the marketing perspective, I will focus on the developers and make sure that you have a practical thesis, a real vision, and that you indeed want to build great technology that people want to use.

How can users confront scamming projects?

Make sure you talk to the team, and look at their white paper and their GitHub to check if they are building. If someone promises you to get rich quickly, it is probably a scam. You should look for signals that they are building real stuff. However, it is quite difficult to distinguish between scams and reals in this space.

Are there any disadvantages of optimistic rollup compared to the zk rollup?

There are three problems to be solved. One is data availability: How can we guarantee everyone gets a complete database? For rollups, we just post all the data on-chain, so that is the same for the zk rollups and the optimistic rollups. The type of data to be posted on optimistic and zk blockchains is quite different, but it will not cause huge advantages or disadvantages.

When the data is posted, how can I convince the smart contract of the bridge that the data is valid and that the database update is correct? This is the second problem as well as the core difference between the optimistic and zk rollups.

Optimistic rollups rely on fraud proofs and the zk relies on zero-knowledge proofs. In the optimistic world of UI on fraud proofs, you say to the bridge or the smart contract: “Here is the database update.” After two weeks, if no one can prove the data is invalid, the bridge will accept it and consider it final.

That one or two-week period is pretty annoying. You have to wait around one or two weeks before the update to the database is applied and finalized. There have been some proposals to bring it down but it is hard to deal with. Because of the nature of fraud proofs, you must find the fraud and then challenge it. As a result, there is always some delay.

On the flip side, as the smart contract does not have to do anything in these two weeks, there is not much computation to be done.

What is nice is that you get low fees. You do not have to worry about producing expensive proof to prove it is valid compared to the zk rollups. For zk, once you produce proofs, you can send them to the bridge alongside the database update. Then the bridge can accept it immediately so there is no one-week or two-week delay.

When you want to aggregate as many transactions as you can, optimistic rollups bring down the fees for producing the proof. It is surprising to see the fees on some zk blockchains last week were 3-4 USD while they were only about 0.8 USD on Arbitrum. It is expensive to produce these proofs right now and it will take a long time to reduce the cost.

How can Arbitrum bring value to the token holders? What is the role of the ARB native token in the ecosystem?

There are three purposes of a governance token. The ultimate use case of the ARB token is to vote on proposals in the DAO. The point of the DAO ultimately is to protect the software. Any community member can submit a proposal with an upgrade to the software. It is up to the DAO to decide whether to upgrade this live network.

For open source software like GitHub, I can download the code, run it locally and contribute code to GitHub. Good open-source software will allow you to have as many deployments of that software as you want.

When it comes to the Arbitrum network, there is only one single instance of that code deployed. The mission of the DAO is to protect and configure the deployment of that software. And this is where the ARB token comes in.

Do the growth, decentralization, and trusted reputation of Ethereum create a solid basis for layer 2 to develop in the future?

Layer 2s will benefit from Ethereum; likewise, rollups are important for Ethereum. Ethereum has about 400 billion USD worth of assets, including ETH and ERC-20 tokens. If the users want to interact with a third-party service like Coinbase or Kraken, they must move their assets to that service.

Whenever you take your assets and move them somewhere else, you have to bridge them. And what has been annoying for the past ten years is that we have always relied on trusted bridges although these bridges keep getting hacked.

For layer 2s and rollups, we attempt to build better bridges with optimal software and not rely on humans. If we can build a good bridge and bug-free software, Ethereum is a fundamental basis for building services on top of it.