BuilderTalk #4: Stride - A journey in Cosmos and beyond

Stride is the first complete liquid staking platform in the Cosmos ecosystem. Through this protocol, users can earn both staking and DeFi profits on the Cosmos IBC. Stride's primary mission is to bring the safest liquid staking experience to users in Cosmos.

Followed with the liquid staking trend on @cosmos. Excited to announce our next eps of #BuilderTalkTheSeries with @shellvish, Co-Founder of @stride_zone!

— Coin98 Super App (Formerly Coin98 Wallet) (@coin98_wallet) March 13, 2023

🗓️ 2:00 PM (UTC), March 15th, 2023

Bring your questions & get ready to join🌟https://t.co/yFR8urUWfZ pic.twitter.com/AWAZH5FWbn

This platform is similar to Lido Finance or Rocket Pool on Ethereum. Instead of users' assets being locked in validators, they can receive derivative assets equivalent to the tokens deposited into the liquid staking protocol.

Stride currently supports a variety of assets on Cosmos such as Cosmos Hub (ATOM), Osmosis (OSMO), Juno (JUNO), Stargaze (STARTS) along with equivalent derivative tokens such as stATOM, stOSMO, stJUNO and stSTARTS.

Stride has seen fastest IBC adoption in history 🔥

— Stride (@stride_zone) March 19, 2023

• Cosmos Hub has been live for 4 years

• Osmosis has been live for 1.75 years

• Stride has been live for 7 months

(Thanks to @cosmolytics for consistently providing awesome Cosmos data charts ❤️) pic.twitter.com/MzNbvEFFJv

The liquid staking protocol Stride has successfully raised $6.7 million from investors such as Pantera, Distributed Global, North Island Ventures, 1confirmation, ... in the seed round. One of Stride's co-founders is Vishal Talasani, who is also the main character in this builder talk event. Before that, Talasani founded a venture fund but later sold it to Dark Forest Technologies.

Additionally, he worked at Bridgewater Associates as a quantum researcher alongside co-founder Edmunds, who worked in the crypto department as a macroeconomics researcher.

When it comes to "build" or "builder", Talasani said he immediately thought of coding and special engineering technologies. He thought that developers working in the crypto industry are in the early stages of blockchain technology.

These people would continue to explore and develop the potential of blockchain and serve as a bridge to simplify technology to make it easier for users to access. They could spend years learning in the field and put their knowledge back into crypto services.

Stride and the challenges faced with liquid staking

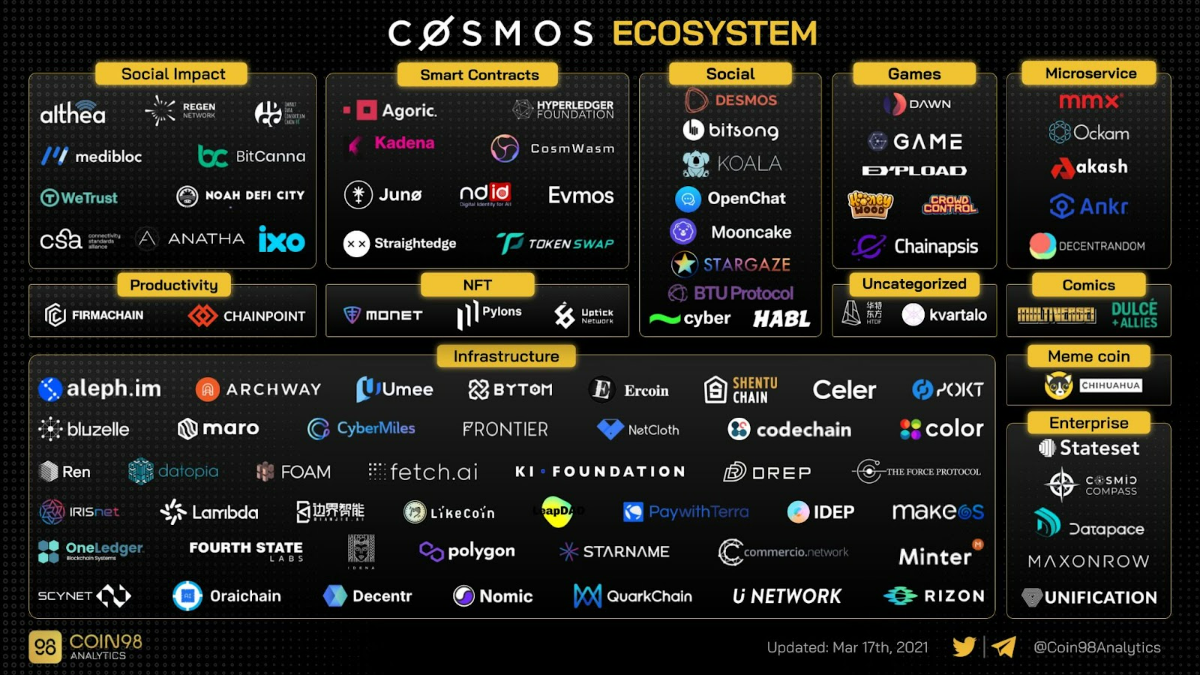

The Stride co-founder emphasized that one of the challenges of Cosmos was turning blockchains into appchains. Unlike Ethereum and Solana, on Cosmos there are various small blockchains. Currently, the Cosmos ecosystem has more than 50 blockchains. Among them, the area that Stride mainly focuses on is liquid staking on most blockchains as well as making tokens more useful in the DeFi world.

Vishal Talasani shared, initially, the Stride team explored the Cosmos ecosystem and felt that this would be the destination of many appchains in the future. Staking platforms also became popular and attracted the attention of many DeFi projects. However, in DeFi there are many liquid staking protocols and each offers a different rate of return.

However, for the tokens to be useful in the DeFi world, Stride thinks some LP tokens are needed to unlock the potential. That makes project developers immediately think of liquid staking with creating profits from tokens while ensuring assets are safe.

The differences of Stride

Notably, Talasani said that on Cosmos there are many liquid staking protocols but Stride owns a difference and strives to maintain them to compete with other projects actively. Unlike pSTAKE or Persistence, Stride builds an open protocol that can connect to other blockchains and makes the safety of user assets a top priority.

The platform focuses on the safety of users staking their tokens into the protocol and fulfills the demand of the community. The project co-founder asserts that it helps Stride position its brand in a series of liquid staking projects on Cosmos.

The liquid staking pioneer in Cosmos

Commenting on Stride’s key milestones, Vishal was proud that it was the first liquid staking protocol in the Cosmos ecosystem. Stride went full launch in September 2022, a few months before revealing its first token for liquid staking, ATOM.

Stride then offered users all the needed functionalities like staking and unstaking. Users could earn rewards such as stATOM, stOSMO, and stLUNA via staking tokens on the protocol. stTOKEN is 100% backed by on-chain TOKEN and can be redeemed at any time.

It gave staking rewards in 6 tokens, including ATOM, OSMO, LUNA, STARS, JUNO, and EVMOS. Stride aimed to support more Cosmos tokens in the future. By the end of the year, Stride also expected to add 5-10 chains with the hope of expanding dozens more.

The team was also working on the governance for Stride. For instance, when holders liquid staked their ATOM on Stride, they would get back stATOM. In the next step, they could utilize these stATOMs for voting on governance proposals. Holders of Stride’s stATOM currently could not vote in Cosmos Hub governance. Once the new feature is available, they will be able to.

The latest development was called Stride appchain. Stride was a multichain liquid staking zone on the Cosmos blockchains. As Stride had no DeFi protocols, stTOKEN must be transferred to other chains. People could buy stATOM and convert it back into ATOM to make a profit.

Vishal hoped that step would bring more value to the Stride ecosystem. In addition, it helped the protocol maintain ample liquidity and make stTOKENs more usable in DeFi spaces. Of utmost importance, developers added various steps to enhance safety on Stride.

They kept eyes on every block that was already smartly intact. If there was an attack on Stride, they could mitigate the issue immediately. According to Vishal, Stride was rolling out another series of safety checks. In addition to the blocks, every transaction was also reviewed constantly.

“We are trying to make Stride data more accessible to DeFi protocols. Now we have 4-5 oracles on Stride. Therefore, it's easier to export and store data or access other DeFi partners,” said Vishal.

Getting liquid staking viral

He insisted almost all DeFi protocols in Cosmos could integrate with Stride. On expanding beyond the Cosmos network, Vishal said the team wanted to focus on Cosmos to deliver qualified products. Vishal pointed out that higher yield in Cosmos was a barrier keeping users from moving to other chains. He thought users could hardly hold ATOM dearly in Ethereum DeFi applications because they missed out on the 25% yield in Cosmos.

However, Stride was finding ways to bring stTOKEN all over the crypto world. The first blockchain that Stride had a keen eye on was Optimism, which had an excellent technology stack and showed friendliness towards liquid staking tokens. When things went smoothly, the protocol was ready to cooperate with more Ethereum-based blockchains such as Arbitrum.

Stride was interested in the Polkadot ecosystem as well. Vishal suggested stTOKEN would onboard the Polkadot DeFi in several months. “Stride has the first connection between the Polkadot and Cosmos chains. [...] We hope to use Stride technologies for liquid staking DOT,” said Vishal.

Vishal hinted a feature called interchain security would be introduced soon. The idea was Stride could share validators with the Cosmos Hub and be secured by the hub. In short, Stride would inherit all economic securities the Hub offered. Though Stride was a small project, Cosmos had spent billions of dollars on security. The project would make sure that it was the safest place for staking.

In terms of governance, the main challenge was bridging stTOKENs to 50 different blockchains. With Interchain Autopilot, users would sign one transaction to liquid stake instead of executing two transactions (an IBC transaction and a transaction on the Stride blockchain) as before. Users just need to hit one button and the protocol automatically bridged tokens for liquid staking.

Q&A

What can I do with stTOKEN? Are there any superior benefits of being a token holder?

The main use case is you can either put it into AMM or stake it. Staking brings along a lot of benefits. For example, you can earn revenue from all the tokens that Stride supports: ATOM, JUNO, OSMO, etc.

Can you share your thoughts on the trend of this year?

Liquid staking tokens can be the core building blocks in DeFi. It’s kind of a win-win. You enjoy the security of the blockchain. The more you stake, the more secure the chain is and the better it functions. Importantly, it helps users earn yield and engage the project's popularity, especially when the technology behind them is good.

In 5 years, I think we will see the majority of tokens are liquid-staked. And we can expect better infrastructure, governance, and processes.

Why do we need Stride if there are other Cosmos liquid staking providers?

First, we have our chain, unlike pSTAKE uses smart contracts of other teams. That means we can use many great things for our safety layer. We execute a bunch of checks to make sure the liquid staking procedure is not under attack.

We are a minimal chain that focuses on only liquid staking. We hope to integrate with all the other amazing projects on Cosmos and unlock the ultimate value of Stride tokens. We’ve done a lot of work on integrating DeFi on Cosmos and making the tokens usable in DeFi. So this means the peg between stATOM and ATOM must be very strong.

We also dig into oracles and other data providers to make Stride’s data more accessible. I think Stride now comprises 80-90% of liquid-staked ATOM and tokens on the Cosmos ecosystem.

How can you ensure all the tokens are staked? Where does the yield come from for the users?

We already have 3 different audits and an ongoing audit program. So Stride has a firm informal system, audits, codes, and an in-progress basis. Because we are on our blockchain, we run a bunch of checks in every single block to see if we are under attack.

If we think that there's an attack or a bug, we can halt functionality on the chain. Another thing we do is monitor how many tokens have been bridged off Stride. If that number is too high, the chain automatically limits the number of tokens to be removed off-chain in one day.

If you see 50%-100% of tokens are removed, it’s most likely there is some sort of attack and the channel is trying to limit potential damages.

What advice do you have for all the builders out there?

You are people who are building such cutting-edge, novel technologies. And I think it’s a privilege to be able to work on these technologies because, in the next 50 years, most online commerce may be in crypto. So I appreciate having an opportunity in front of us.

The bear market may be a little bit disheartening to build. However, just keep in mind that many good projects have been done in the bear market. I think it’s a great chance to take a step back from all the market’s craziness and focus on core building.

Last but not least, you need to make sure your project has a good idea and roadmap. A bear market is a great time to hire and a great time to build, but you need to do it in a way that can sustain that growth.